Before you start trading on the investment platform, you need to determine the level of risk you are willing to take. This indicator depends directly on the amount with which you want to open a position.

Determine the ideal risk

The idea is to keep the risk level below 20% of your total capital used for trading. For example, if the total capital is a thousand dollars, it’s best to open a position of up to 200. In the event of failure, you can open several new positions and recover. If this indicator is 50% or more, it will be much more difficult to do this.

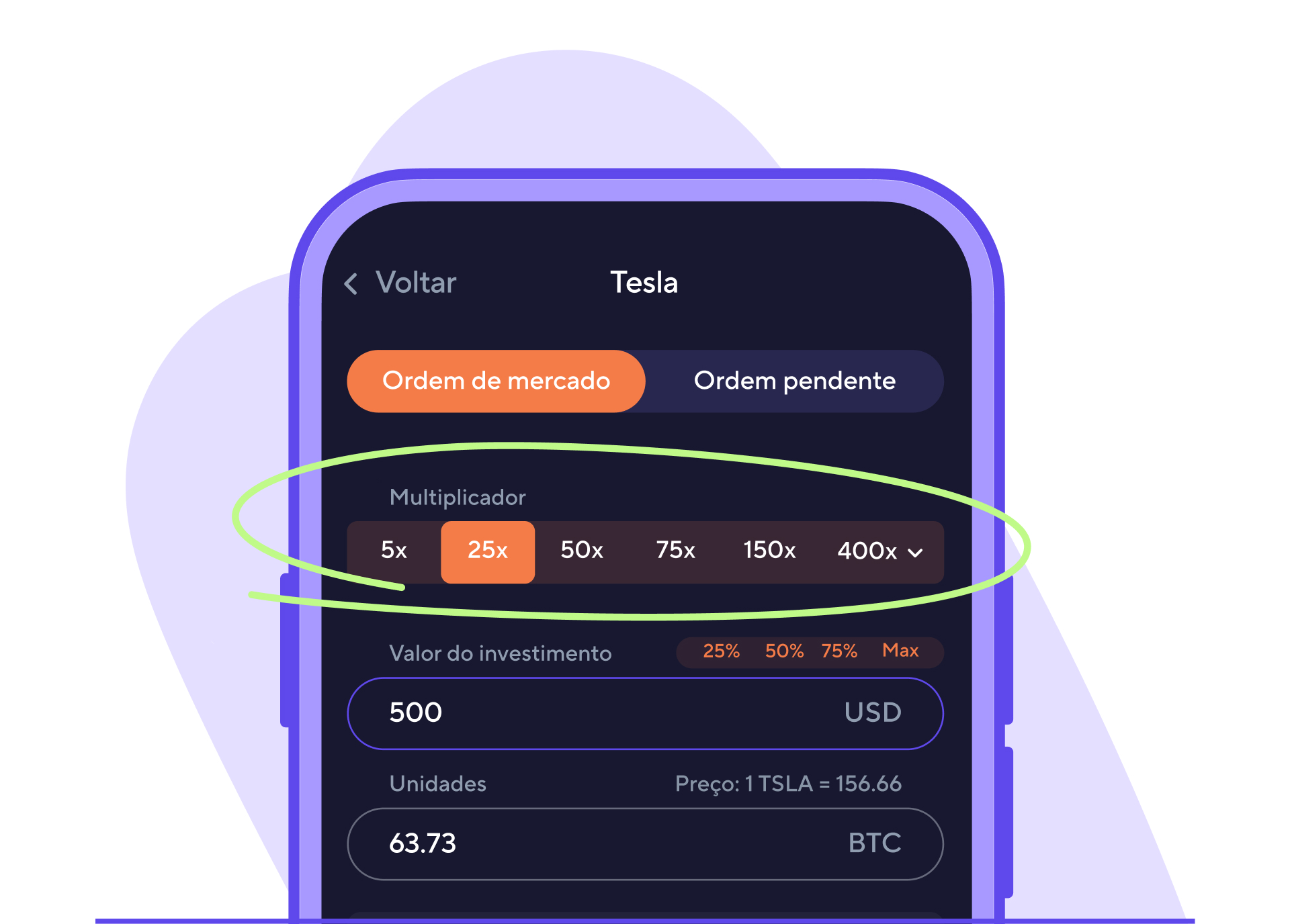

Set the multiplier value

To minimize the risks, especially if you are a beginner, choose a small amount for the multiplier, for example, 3х or 5х.

Relate risk to gain

Always pay attention to the risk reward ratio (RRR). A strategy in which you risk a thousand dollars to win 100 is not profitable in the long term. In the event of failure, you’ll need to close 10 successful positions in a row to at least break even.

In a balanced option, the risk to gain ratio should be 1:1 or 1:2.

Diversify your risks

Even in a globally rising or falling market, each currency offers different returns, so by opening positions in two or more pairs, you protect your risks.

For example, instead of opening a position in one currency for a thousand dollars, it’s better to open two positions of 500 in two different currencies.

You can also manage risks by opening positions in stable currencies with a high value and, for high-risk currencies, leave a small value, proportional to the expected gain.

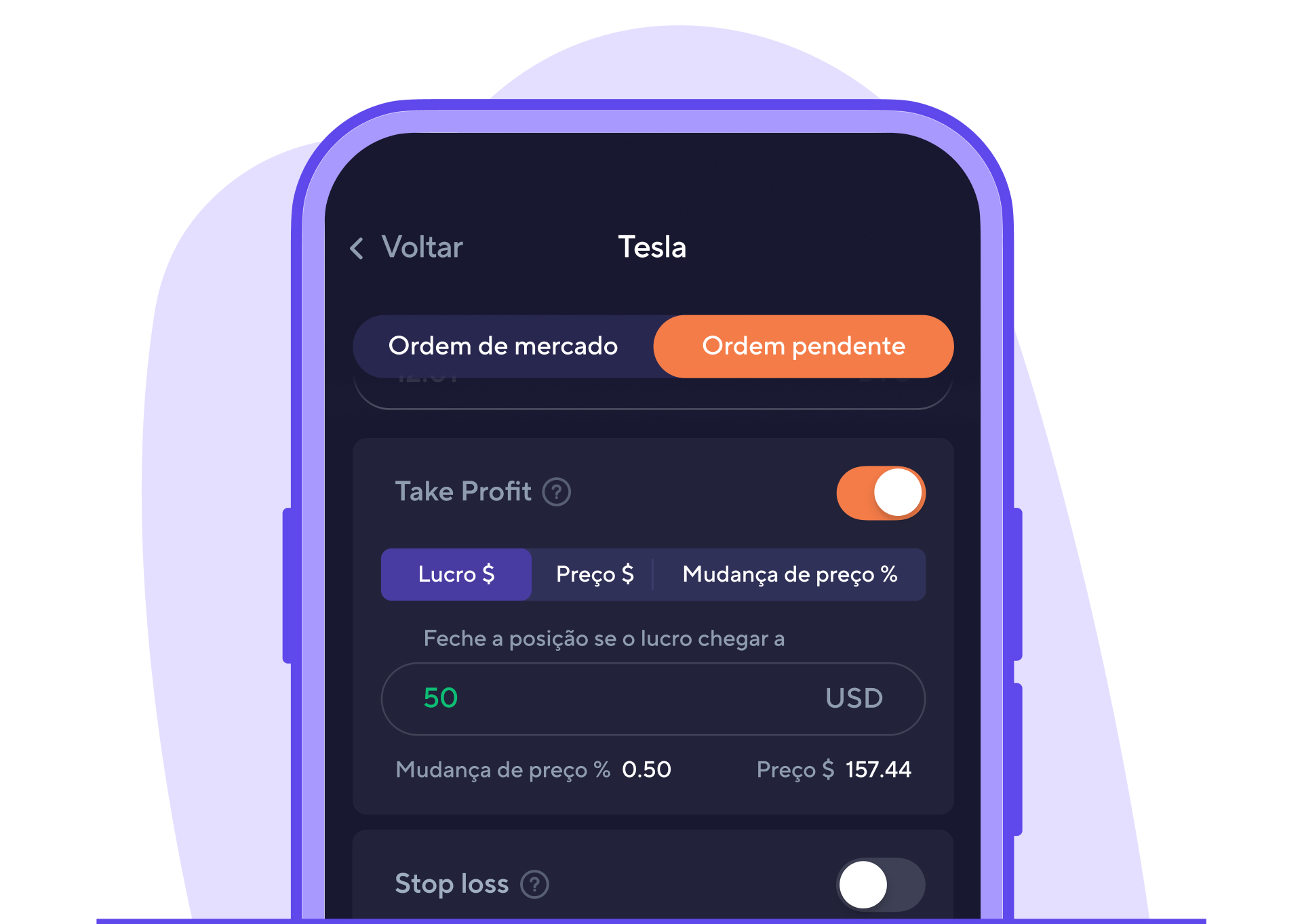

Set a Stop Loss

A successful trade can’t take place without establishing gains and losses. The principle of isolated investment governs the MOVO platform. This means that your losses in one position cannot be covered at the expense of another.

One of the most important components of risk management and trading strategy in general is determining the levels at which you plan to close a position in profit.

To limit losses, it is always advisable to set a stop loss, which will close the position when the market price reaches the level you set.

The more precise the levels, the more stable your profits will be. Often, inexperienced traders succumb to emotions and don’t close positions when they reach their forecasts, which seriously increases the risk of losing funds.

Important tips to reduce the risks of negotiation

Despite the risks, investment trading remains an effective way of trading cryptocurrencies. Below are some simple tips for profitable trading:

- Determine the investment amount based on the total value of your savings and willingness to take risks.

- Choose the multiplier based on the amount of risk, market volatility, and investment horizon.

- Set a stop loss to limit your losses and close the position after reaching a certain profit level.

- Set your targets and stops before entering a position to rule out panic decisions.

- Stick to your chosen strategy. If the current market situation doesn’t suit your strategy and you can’t make clear predictions, it’s best to wait until the situation stabilizes and you see a trend.

For successful long-term negotiations, it is necessary to negotiate with low risk, so that in the event of an unsuccessful transaction, there is always an opportunity to recover.

Download the App